When planning for the transfer of wealth, promissory notes often play a central role. Whether used as part of an intrafamily loan strategy, a sale to an Intentionally Defective Grantor Trust (IDGT), or to facilitate liquidity for estate settlement, promissory notes must be properly valued to comply with federal gift and estate tax requirements. While the face amount of a note may seem like an obvious starting point, courts and the Internal Revenue Service (IRS) recognize that the fair market value (FMV) of a promissory note may be different—and that difference can have material tax implications.

This article outlines the key legal guidance, judicial precedent, and practical methodologies that inform the FMV of promissory notes, and offers insight into how valuation professionals approach these assignments in the context of wealth transfer.

The Regulatory Landscape: Fair Market Value Is Not Always Face Value

For gift and estate tax purposes, FMV is defined by Treasury Regulations §§20.2031-1(b) and 25.2501-1 as “the price at which property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.

Regarding debt instruments such as promissory notes, Regulations §20.2031-4 and §25.2512-4 state that the FMV is presumed to be the amount of unpaid principal plus accrued interest. However, this is only a starting point. If credible evidence indicates the note is worth less due to credit risk, marketability, or other factors, the FMV can be discounted accordingly.

Revenue Ruling 67-276 reiterates this principle, clarifying that quotations or broker opinions are not sufficient. Instead, a comprehensive analysis of all relevant financial data and risk factors is required.

Is It a Loan or a Gift? Establishing Bona Fide Indebtedness

Before valuing a note, one threshold question is whether it is in fact a valid debt instrument. The IRS may characterize an intrafamily note as a disguised gift if the arrangement lacks hallmarks of a bona fide loan. In Estate of Lockett v. Commissioner , the court evaluated nine factors drawn from Miller v. Commissioner to determine if a legitimate lending relationship existed:

- Presence of a written note or instrument

- Presence of security or collateral

- Changing of interest

- Existence of a fixed maturity date

- Evidence of demand for repayment

- Actual repayments made

- Proper record keeping of the transaction

- Consistent treatment for tax reporting

- Borrower’s ability to repay

Failure to satisfy several of these factors may lead to recharacterization, resulting in unintended gift tax exposure.

Judicial Guidance: Key Cases on Note Valuation

In Bernat v. Commissioner, the Tax Court concluded that five unsecured 20-year promissory notes issued by the decedent’s daughter and son-in-law were not the product of an arm’s-length transaction. Key considerations included the lack of security, the advanced age of the lender, and the failure to require principal payments until maturity. Based on these risks, the court concluded that the FMV was significantly less than face value.

In Smith v. United States, similarly to Bernat, the estate owned a large note issued by a publicly traded company. The analysts started with the issuer’s publicly traded bond yield and then applied a series of adjustments to account for features like lack of marketability, subordination, and an unusual payment structure. The court accepted a higher discount rate, reflecting these added risks.

In Estate of Hoffman v. Commissioner, both parties agreed that the FMV was not equal to the face amount. The court weighed competing expert opinions and found that the estate’s proposed discounts were excessive and not adequately supported by the evidence. The key issue was identifying an appropriate required rate of return based on market yields for similar risk profiles.

How Promissory Notes Are Valued: A Cash Flow Approach

The valuation of a promissory note typically involves discounting its expected future payments (principal and interest) to present value, using a market-based, risk-adjusted rate of return. This approach requires professional analysis to:

- Model the cash flows according to the payment terms

- Assess the risk characteristics of the note and its issuer

- Select a discount rate commensurate with that risk

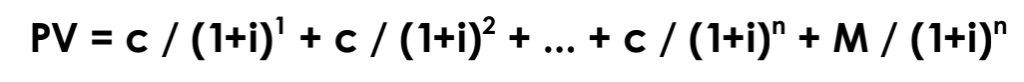

The present value formula often resembles that used in bond pricing:

Where:

- PV = present value (i.e., FMV)

- c = periodic interest payment

- i = required yield or discount rate – Chaffe utilizes multiple sources to develop appropriate required yields when valuing promissory notes, including the Pepperdine Private Capital Markets Project, GF Data, corporate bond yields, and other market-based benchmarks.

- n = number of periods

- M = maturity value (i.e., principal)

Key Risk Factors That Affect Valuation

Each note is unique, and valuation professionals consider a range of factors that can impact the required rate of return:

- Payment terms: Balloon payments, extended maturities, or deferred interest increase risk (less valuable)

- Security: Secured notes carry less risk than unsecured ones (more valuable)

- Borrower creditworthiness: Borrowers who are solvent and have a track record of timely payments are considered less risky (more valuable)

- Marketability: Notes that cannot be easily transferred or sold may warrant a further discount (less valuable)

- Size and divisibility: Large, illiquid notes may carry higher risk (less valuable)

- Documentation and covenants: Well-documented notes with enforceable covenants are typically less risky (more valuable)

These factors collectively influence how investors (or hypothetical buyers) would price the risk of holding the note.

Beyond Face Value: When Discounts Are Justified

While a face-value-plus-accrued-interest assumption may be acceptable in straightforward cases, any deviation from market norms or added uncertainty can lead to a justified discount. Courts have consistently affirmed this, provided the supporting analysis is credible and well-documented. For example, a 20-year, unsecured, non-amortizing note issued to a family member is far less marketable than a publicly traded bond—and should be valued accordingly. Conversely, a short-term, fully amortizing, secured note from a solvent borrower

bearing a market interest rate might warrant little or no discount.

Strategic Planning Implications

The valuation of promissory notes can have a significant effect on estate and gift tax outcomes. A properly supported discount can reduce the taxable value of a gift or be used to minimize the value included in a gross estate. However, aggressive or unsupported valuations may invite IRS scrutiny. Accordingly, when engaging in estate planning strategies that involve promissory notes—especially with related parties or trusts—it is important to obtain an independent valuation that is supported by sound methodology and aligned with judicial precedent.

The Chaffe Approach

Chaffe takes into account the full range of legal, economic, and financial factors relevant to each assignment, and Chaffe tailors its analysis to the specific terms of the note and the profile of the borrower. Chaffe’s valuation models are defensible, practical, and designed to withstand scrutiny. Whether you are a CPA advising a client, an attorney structuring a trust, or a business owner considering an intrafamily transaction, understanding the nuances of note valuation is essential. For clients seeking clarity and compliance in this complex area, Chaffe is here to help.

Chaffe & Associates, Inc. (“Chaffe”) provides highly specialized investment banking services to its clients including a full suite of transactional advisory services along with valuations for a multitude of needs. Chaffe leverages both of these core competencies

to create a powerful finance firm that always places its clients first. Founded in 1982, our clients range from sponsors, founder-led and family-owned businesses to publicly traded corporations spanning a broad spectrum of industries.

Ryan Gerton, ASA, is an Associate in the Valuation Advisory Group of Chaffe & Associates, Inc. He has several years of experience in

business valuation and reasonable compensation reporting. Ryan provides valuation services to private companies for estate, gift, and

income tax planning, corporate planning, employee stock ownership plans, and litigation.