G.F. Gay Le Breton and Mitch Murray, Chaffe & Associates Inc.//January 29, 2026

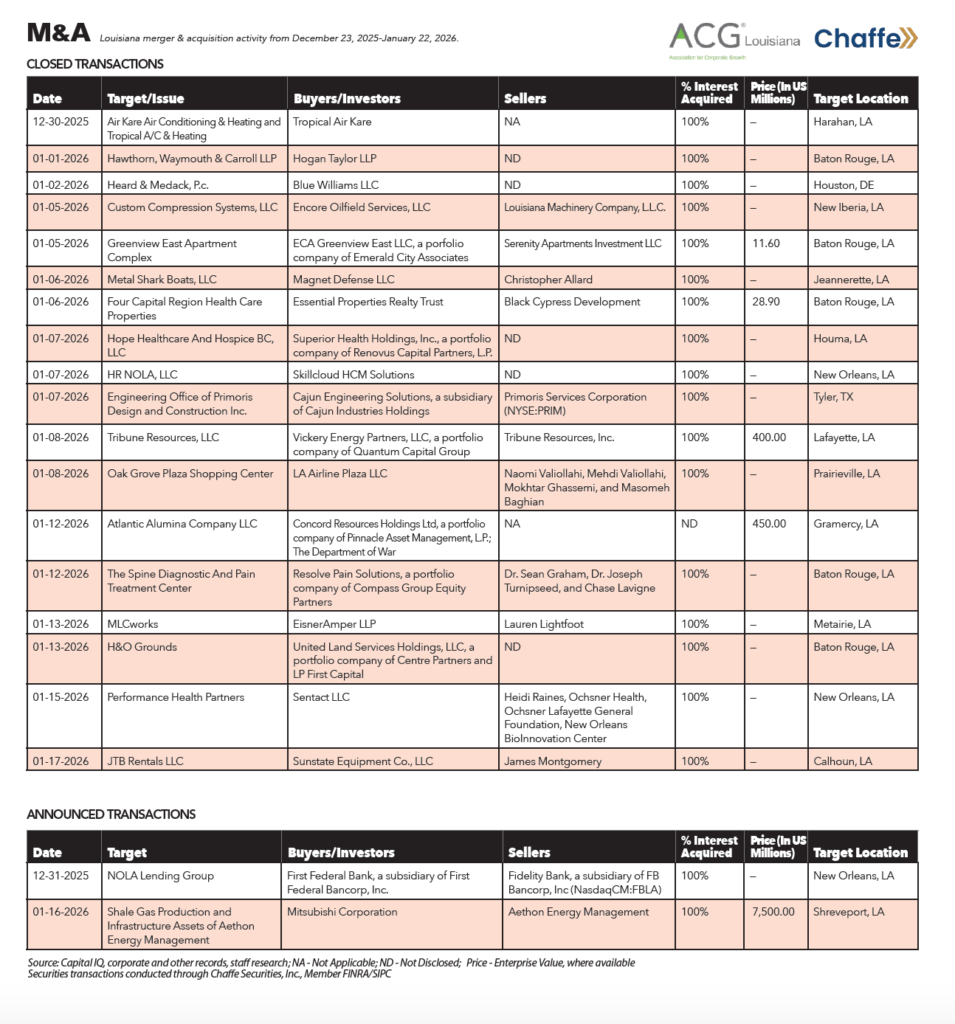

Louisiana’s defense and national-security manufacturing base were front and center in January, with two completed transactions. In the first, Jeanerette-based Metal Shark Boats, LLC sold to Miami-based Magnet Defense LLC. In the second, Gramercy-based Atlantic Alumina Company LLC received a $450 million equity investment from the United States Department of War and Concord Resources Holdings Limited in conjunction with Concord’s majority shareholder, a fund managed by Pinnacle Asset Management, L.P.

These deals came on the heals of the announcement in December that Saronic Technologies is investing $300 million to expand its autonomous surface vessel shipyard in Franklin. Saronic purchased the shipyard from Gulf Craft in April 2025.

Magnet Defense LLC is a defense technology company focused on autonomous, AI-enabled maritime platforms for fleet operations and missile defense missions. In acquiring Metal Shark, Magnet Defense expects to integrate its robotics and AI-enabled, software-defined systems with Metal Shark’s well-established shipbuilding operations, workforce, and facilities. The combined company will supply AI-enabled unmanned surface vessels to U.S. and allied militaries, with Metal Shark’s shipyards serving as production hubs for Magnet Defense programs, including the U.S. Golden Fleet initiative.

Founded in 1986 and previously led by Chris Allard, Metal Shark has grown into one of the nation’s leading builders of patrol boats, response vessels, and specialized military craft. It has delivered more than 2,000 vessels worldwide. The company operates two manufacturing facilities in Louisiana totaling more than 125,000 sq. ft. across 40 acres.

The $450 million partnership between Atlantic Alumina, operator of the Atalco refinery in St. James Parish, and the United States Government and Concord Resources strengthens Louisiana’s role in the United States critical materials supply chain. The deal will sustain and increase domestic alumina production and establish the country’s first and only large scale primary gallium production circuit.

The Atalco refinery is the country’s only operating alumina refinery. Founded in 1959, the facility has long supplied alumina used across aerospace, automotive, and defense applications. Ownership of the refinery has evolved over the past decade, including a period under DADA Holdings from 2016 to 2021, before London-based Concord Resources Holdings increased its minority position to a controlling stake.

The latest investment—comprising $150 million from the U.S. Department of Defense and $300 million from Concord—will fund a modernization of the Gramercy facility, including construction of the gallium production circuit. Gallium is a critical input for semiconductors, radar systems, and advanced defense electronics. Overall, this project will advance national security, support advanced manufacturing and reduce dependence on foreign supply chains dominated by China.

Saronic’s $300 million expansion of the former Gulf Craft facility also reflects growing investor and government focus on Louisiana-based assets that support defense tech and readiness. It will add more than 300,000 square feet of production space, three additional vessel slips, expanded warehousing, and a dedicated large-vessel assembly line to scale production of next-generation unmanned surface vessels, including the 150-foot Marauder. Construction is underway and expected to conclude in 2026, with expanded operations beginning in 2027. Saronic estimates the project will create approximately 1,500 direct jobs, while Louisiana Economic Development projects an additional 1,700 indirect positions—more than 3,200 total jobs—supported across the Bayou Region.

Other Louisiana companies are benefiting from contracting with defense technology firms on autonomous vessel construction as well. According to The Maritime Executive, Boston-based Blue Water Autonomy has signed a production agreement with Conrad Shipyard, a longtime workboat and dredger builder in Conrad City, Louisiana, for a “fleet-scale” line of unmanned vessels.

G.F. Gay Le Breton is managing director for Chaffe & Associates Inc., responsible for the corporate finance activities of the firm. Mitch Murray is a corporate finance analyst with the firm. Investment banking services are provided by Chaffe Securities Inc., member FINRA/SIPC. For more information, visit http://chaffe-associates.com.