H1 2025 Review

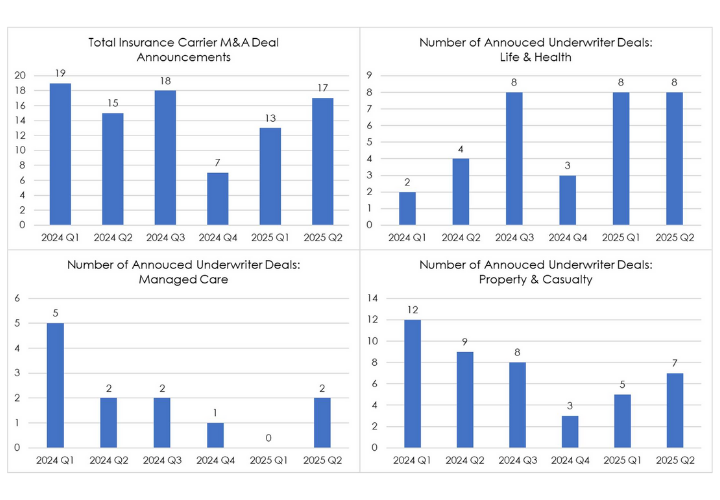

We are excited to share our Insurance Underwriters Industry Report, featuring our insights into mergers and acquisitions activity among underwriters in the Life & Health, Managed Care, and Property & Casualty segments. We address overall deal activity, assets and interests being bought/sold, disclosed prices, notable deals, and activity among financial buyers.

1) Life and Health

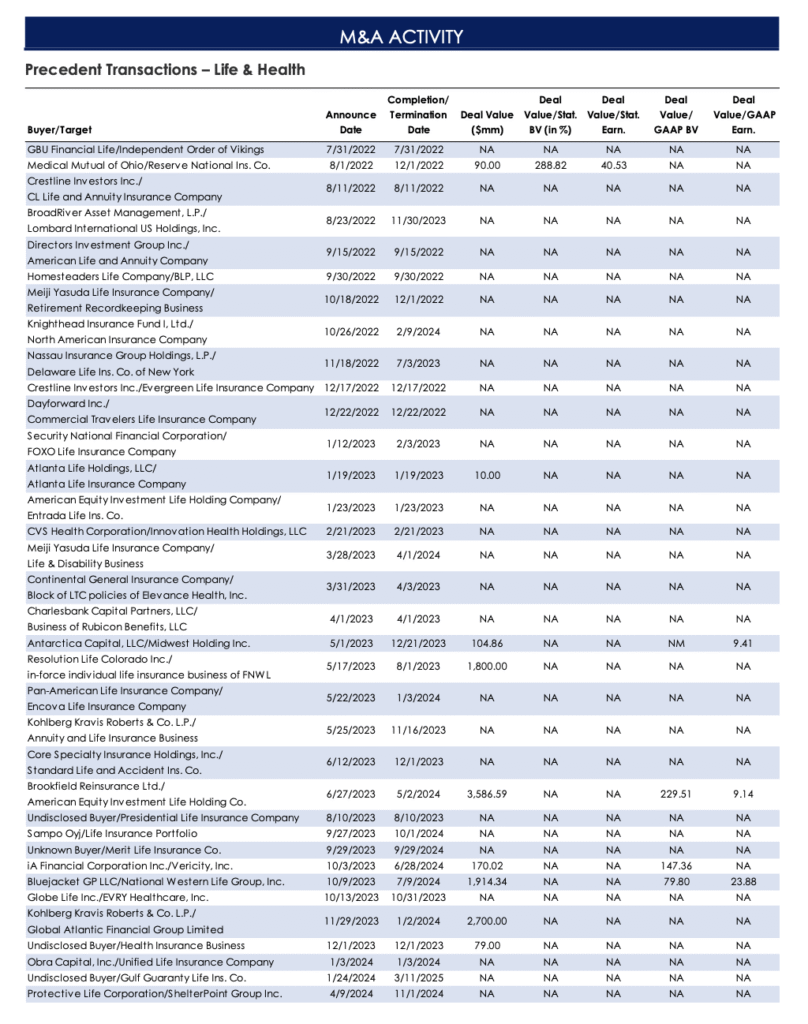

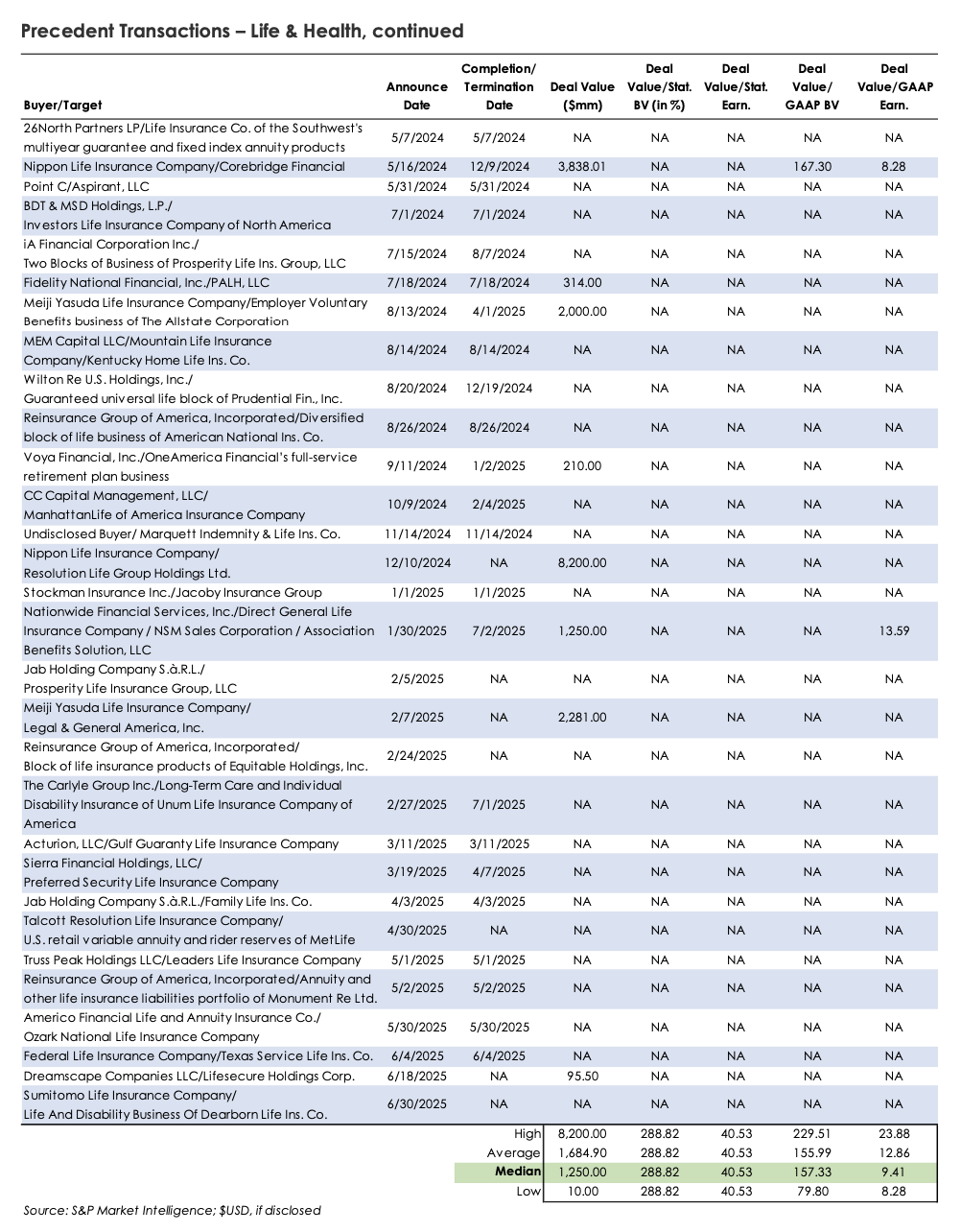

- Life & Health M&A got off to a strong start in 2025, with 16 announced deals in the first six months of the year, compared to six in the first half of 2024.

- The 16 announced H1 2025 deals included four assets (closed blocks or non-core product lines) and 12 for controlling interests. Of the six Life & Health deals announced in H1 2024, one was for a block of business, and five were for controlling interests.

- Total disclosed deal value for H1 2025 was $3.6 billion, down from $3.83 for H1 2024.

- Strategic acquirers pursued expansion into high-growth niches. Nationwide Financial Services, in its largest acquisition in nearly 25 years, announced that it will acquire Allstate’s group health business for $1.25 billion. The transaction is focused on a business line, employer medical stop-loss, that Nationwide has been growing steadily in recent years.

- Elevance Health’s acquisition of Granular Insurance also reflected the growing demand for stop-loss and level-funded employer health coverage solutions, as employers seek cost control in a tightening benefits market.

- In H1 2025, Meiji Yasuda Life Insurance Company announced that it will acquire Legal & General America, Inc. for $2.3 billion, and Sumimoto Life’s subsidiary Symetra Life announced that it will acquire the life and disability business of Dearborn Life for an undisclosed price. This follows Meiji Yasuda’s $2.0 billion acquisition of the Employer Voluntary Benefits business of The Allstate Corporation which closed this April, as well as Nippon Life’s $12 billion buying spree last year, underscoring continued Japanese interest in U.S. life markets, driven by demographic pressures at home.

- Private equity was involved in three Life & Health sector deals during the first half of 2025. Private equity involvement as buyer or seller totaled three Life & Health deals in 2024, after four in 2023 and six in 2022.

- Health premiums have continued to grow during 2025. Elevated drug spending (notably new therapies like GLP‐1s in health plans where covered) and general healthcare inflation are key contributors to premium growth.

- Life insurers are shifting toward accumulation-based products (IUL, VUL) and improved underwriting through AI, while adjusting distribution to younger, tech-savvy customers.

2) Managed Care

- Two managed care deals were announced in H1 2025, down from seven in H1 2024.

- In H1 2025, CareSource, one of the nation’s largest non-profit Medicaid providers, finalized its acquisition of Commonwealth Care Alliance, aiming to boost the operating efficiency of the disability and community-based care specialist. CareSource also closed its acquisition of Common Ground Healthcare Cooperative, which had faced challenges growing its business while maintaining affordable premiums. That deal was announced last February.

- Preventative care specialist Nice Healthcare Management acquired Decent, Inc. in a bid to tap its expertise in care navigation and chronic condition management.

- None of the 2025 deals had publicly disclosed pricing information. (H1 2024 disclosed value totaled $3.8 billion).

- Compared to H1 2024, managed care insurers have generally adopted a wait-and-see approach, prioritizing operational performance and regulatory navigation over expansion through acquisition. Heightened antitrust scrutiny, particularly for transactions involving provider or PBM integration, has added another layer of complexity and slowed strategic combinations.

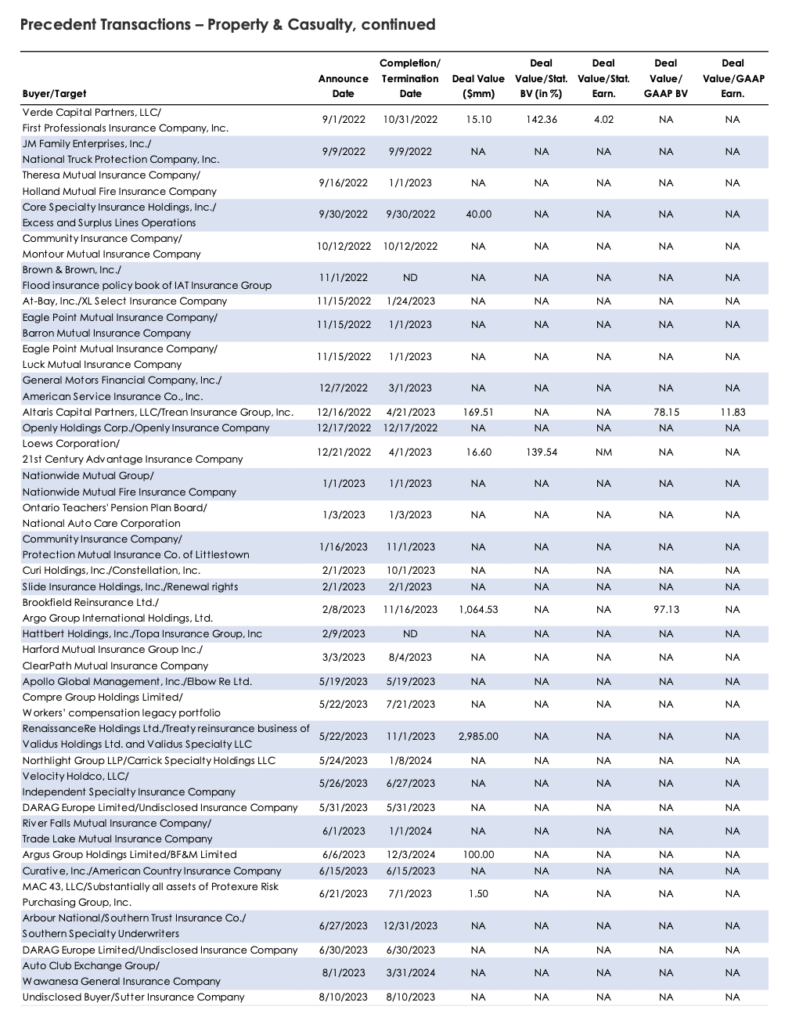

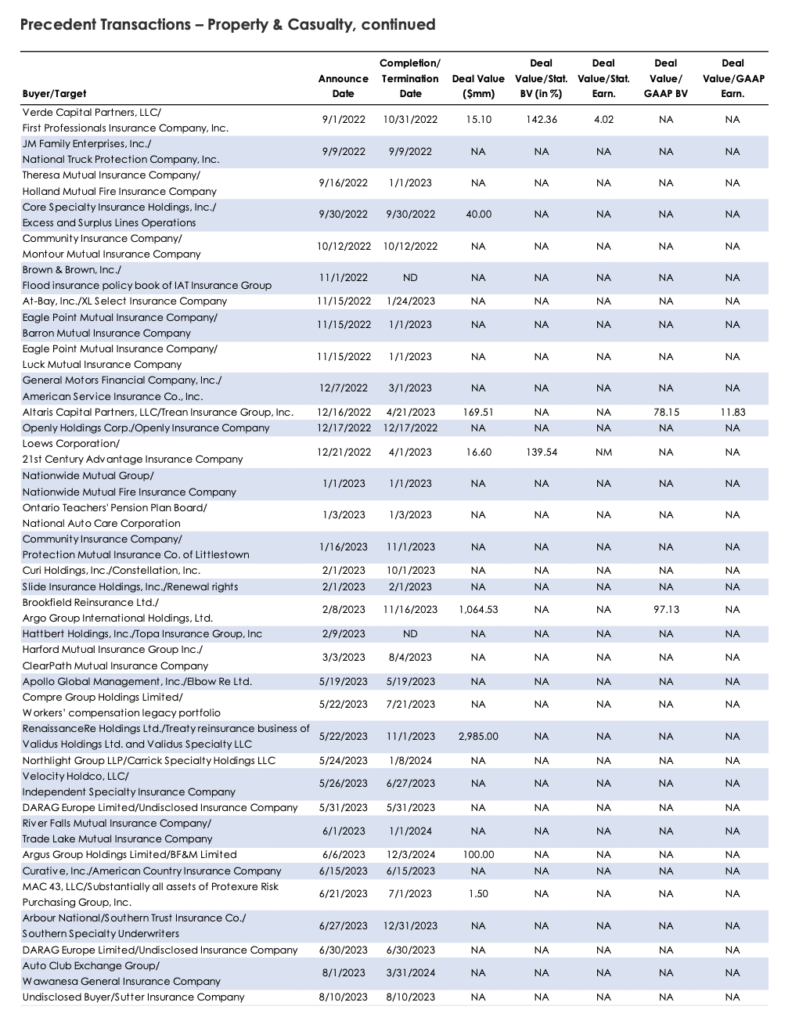

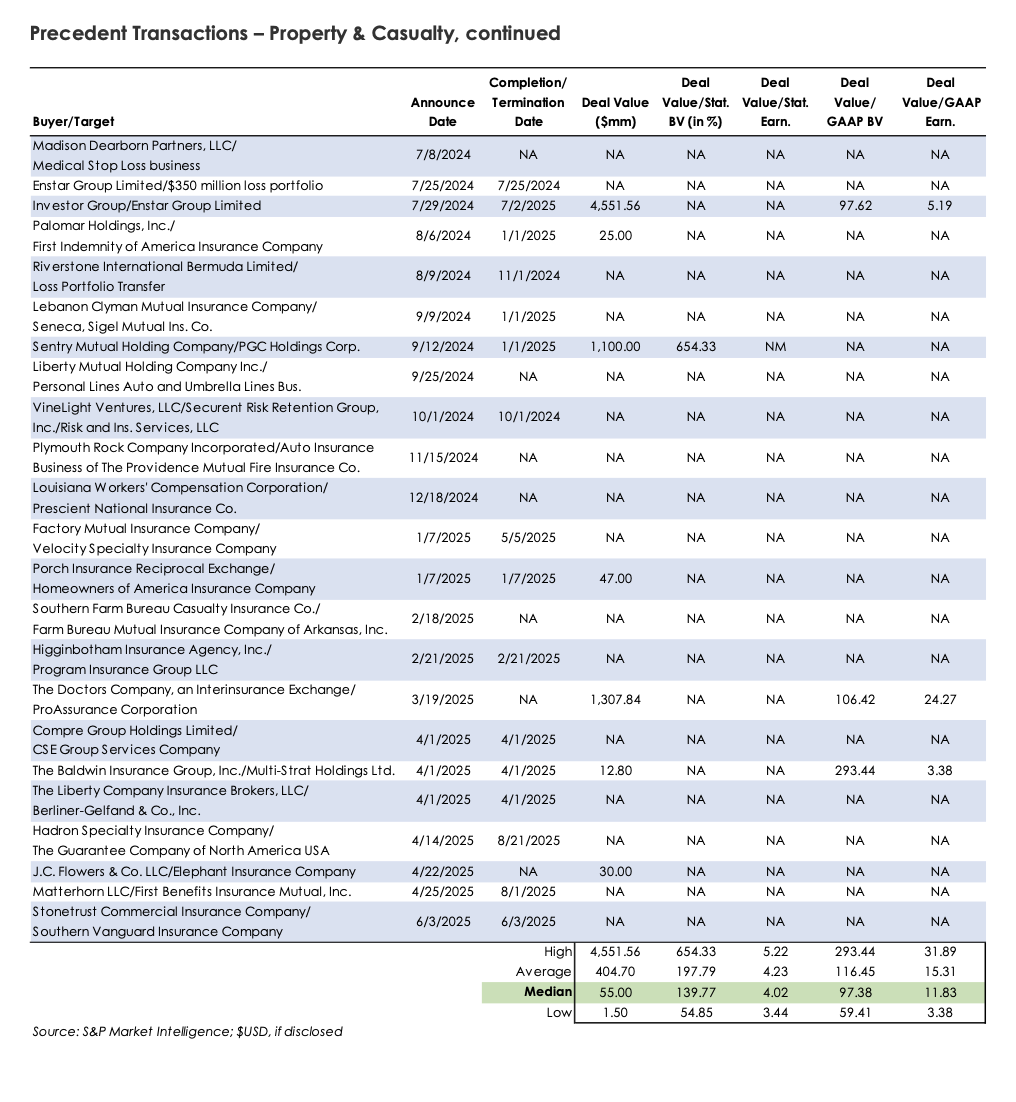

3) Property & Casualty

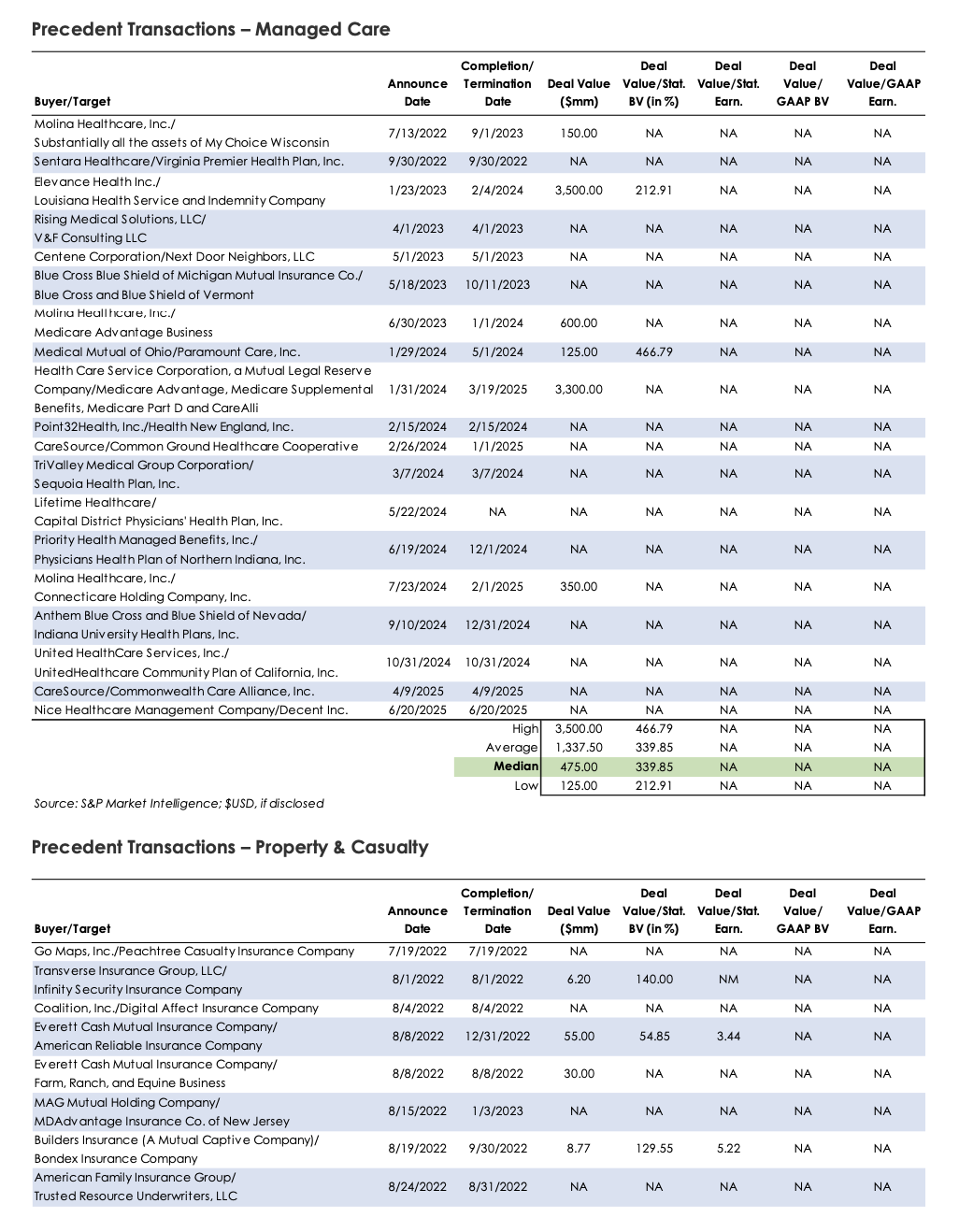

- P&C deal activity rebounded in the first half of 2025 following a slow end to 2024. However, this segment’s 12 announced deals in H1 2025 remained significantly below the 21 deals in H1 2024.

The 12 announced deals in H1 2025 were all for controlling interests. Deal activity in H1 2024 was more diverse, with a minority interest acquisition, three insurance asset deals, and three deals involving private equity. - Total disclosed P&C deal value for H1 2025 was $1.4 billion, compared to $2.25 billion for the same period of 2024.

There were no private equity deals in H1 2025, compared to three in H1 2024, as rising interest rates and volatile debt markets continue to stall activity. - Physician-owned medical malpractice insurer The Doctors Co. an Interinsurance Exchange announced that it is acquiring Alabama-based medical liability provider ProAssurance Corp. in a transaction valued at approximately $1.3 billion. This deal will unite the second and fourth-largest medical professional liability insurers in the country.

- M&A activity among mutual P&C insurers in 2025 is being driven less by strategic expansion and more by necessity. Catastrophe losses, reinsurance costs, and inflation have eroded mutuals’ capital positions, leaving mutual-to-stock conversions and affiliations as primary tools for survival. There is likely to be continued consolidation of smaller, regional mutuals, with healthier players and outside investors stepping in to stabilize struggling entities.

- In the first half of 2025, U.S. P&C insurers saw premium growth of roughly 7–8%, supported by firm casualty pricing and moderating personal auto trends, while commercial property rates softened on abundant capacity and reinsurance price relief.

Underwriting profitability stabilized near break-even, aided by improved auto results and strong workers’ compensation performance, though elevated catastrophe losses—particularly from the Los Angeles wildfires—kept combined ratios under pressure. - Investment income rose as carriers reinvested at higher yields, providing an earnings cushion but not enough to offset the ongoing risks from social inflation in casualty lines and the potential for late-year CAT volatility.

Experience Highlights

Chaffe offers independent valuations and guidance for transactions, financial reporting, tax planning and strategic business decisions.

- Fairness Opinions

- Mutual to Stock Conversions

- Purchase Price Allocations

- Buy/Sell-Side Transactions

- Equity Incentive Plans

- Equity Buy-ins

- Share Repurchases

- Corporate Planning

- Income Tax

- Investment Asset Valuations

- Estate Planning

- Charitable Deductions

Industry Segment Experience

Property & Casualty

- Homeowners and Fire Insurance

- Commercial & Personal Auto

- Marine Insurance

Health & Life

- Managed Care / Medicare Advantage

- Life / Annuity Products

- Dental and Vision Coverage

Specialty Lines

- Mechanical Breakdown / Vehicle Service

- General Liability

- Worker’s Compensation

Chaffe & Associates, Inc. (“Chaffe”) provides highly specialized investment banking services to its clients including a full suite of transactional advisory services along with valuations for a multitude of needs. Chaffe leverages both of these core competencies to create a powerful finance firm that always places its clients first. Founded in 1982, our clients range from sponsors, founder- led and family-owned businesses to publicly traded corporations spanning a broad spectrum of industries.

For more information, contact:

Vanessa Brown Claiborne

CPA/ABV, ASA, AEP

vbrown@chaffe-associates.com

Marc Katsanis

ABV, CFA, CPVA

mkatsanis@chaffe-associates.com