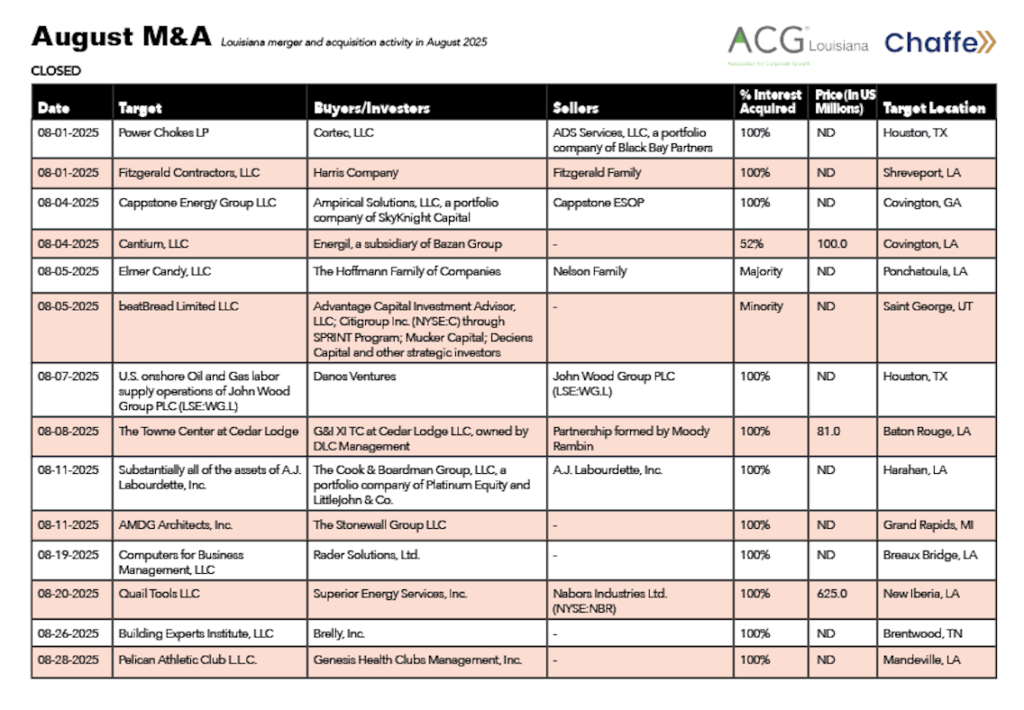

G.F. Gay Le Breton and Mitch Murray, Chaffe & Associates Inc.//September 15, 2025

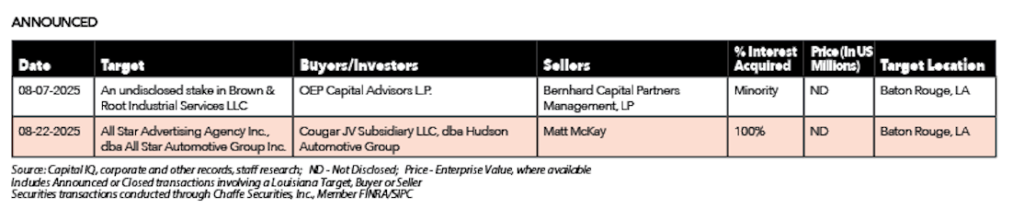

In what may be the largest auto dealership transaction in Louisiana history, Baton Rouge-based All Star Automotive Group has agreed to sell for a reported $700 million. The buyer is Charleston, South Caroline-based Hudson Automotive Group.

All Star was founded nearly four decades ago by Matt McKay, along with his former partner, John Noland Sr., whom McKay later bought out. The auto network includes 14 brands across 13 rooftops in Baton Rouge, Denham Springs, and Prairieville. Although terms of the sale were not announced, sources told The Advocate that the deal is valued at approximately $700 million. This includes an estimated $200 million of owned real estate, $80 million in group brand value, along with additional inventory and tangible assets.

Hudson Automotive, which currently operates 55 dealerships across eight Southern states, will assume control of marquee franchises in Louisiana such as Chevrolet, Hyundai, Genesis, Toyota, Kia, and Ford. The company currently owns Royal Honda in Metairie. The deal increases Hudson’s Louisiana presence more than tenfold and, unexpectedly, makes it the largest dealership group in the state.

“I didn’t realize that until they told me after the transaction was done,” said Hudson CEO David Hudson, on becoming Louisiana’s largest automotive dealer.

No job cuts are expected among All Star’s 700+ employees, and Hudson has expressed intent to maintain operational continuity. CFO Chris Donner noted that All Star intentionally pursued an out-of-state buyer to preserve confidentiality and minimize disruption.

While the transaction remains subject to approval from each vehicle manufacturer, if completed, it will surpass the state’s previous dealership record—the $280 million sale of the Brandt Group in 2024.

Superior Energy Acquires Quail Tools from Nabors in $600M Deal

Superior Energy Services has acquired New Iberia-based Quail Tools from Nabors Industries in a deal valued at $600 million and adjustments in working capital. The deal also includes a Preferred Supplier Agreement, naming Superior as the primary provider of rental drill pipe for Nabors’ U.S. operations. Superior expects the move will significantly expand its footprint in the premium tubular rental market across both U.S. and international land and offshore markets.

For Nabors, the transaction is expected to reduce net debt by more than 25%—roughly $625 million—while generating over $50 million in annual interest savings.

Founded in 1977, Quail Tools is known for its high-spec inventory of drill pipe, landing strings, and pressure control equipment. Its assets will now be integrated into Superior’s broader rental portfolio, which includes Workstrings International, Stabil Drill, and HB Rentals, creating one of the most comprehensive and geographically extensive rental platforms in the industry.

“This acquisition is the first major milestone in our ongoing strategy to build a global platform of industry-leading capabilities,” said Dave Lesar, Chairman and CEO of Superior Energy Services. “Quail’s best-in-class U.S. facilities and inventory allow us to serve all major U.S. energy plays with greater efficiency.”

Nabors CEO Anthony Petrello called the deal “a textbook win-win,” noting that Quail Tools, acquired just a year earlier via the Parker Wellbore deal, had already outperformed expectations, generating $150 million in adjusted EBITDA in 2025. By monetizing Quail now, Nabors accelerates more than five years of projected free cash flow from the Parker acquisition while retaining its international and rig-related assets.

Bazan Makes $100M Upstream Leap with Louisiana Oil Investment

Bazan Group, Israel’s largest energy and refining company, has made its first move into upstream oil production with a $100 million investment in Covington, Louisiana-based Cantium, a Gulf Coast operator with offshore assets in the shallow waters of the Gulf of Mexico

The transaction was executed through Bazan’s fully owned U.S. subsidiary, Energil, which now holds a 52% controlling stake in Cantium. Founded in 2016, Cantium operates producing fields and legacy infrastructure near Bay Marchand and Main Pass. In 2024, its operations yielded 6.7 million barrels of oil equivalent, with net income of $158 million, and are projected to deliver up to $230 million in EBITDA in 2025.

The deal values Cantium at $275 million, with a roughly 1.2x multiple based on projected 2025 EBITDA.

“This is a breakthrough for Bazan,” said Chairman Moshe Kaplinsky. “It gives us full value chain integration and strengthens our long-term stability.” The transaction supports Bazan’s strategy to enhance energy resilience, secure supply, and diversify revenue. Cantium’s experienced team will remain in place under Bazan’s operational control.

G.F. Gay Le Breton is managing director for Chaffe & Associates Inc., responsible for the corporate finance activities of the firm. Mitch Murray is a corporate finance analyst with the firm. Investment banking services are provided by Chaffe Securities Inc., member FINRA/SIPC. For more information, visit http://chaffe-associates.com.